Last updated 20 January 2023

Alongside the risks that exist for charities generally, there are additional risks associated with Australian charities who operate overseas, or work with a third party overseas.

In late July 2019, the External Conduct Standards (ECS) were specifically implemented to impose additional compliance/governance standards on these charities. All charities registered under the Australian Charities and Not-for-profits Commission Act 2012 must comply with the ECS (refer to our previous article here).

When is a charity considered to be working overseas?

Even in the circumstances where a charity’s activities only involve sending a small amount of money overseas, or the overseas work they take part in is minor or undertaken by another organisation on the charity’s behalf – then it is still considered to be operating overseas and therefore subject to comply with the ECS.

Other, more general examples of a charity working overseas include:

- Undertaking activities overseas

- Sending money

- Sending resources

- Sending staff, volunteers, members or beneficiaries to assist with aid

- Funding overseas activities

- Working with individuals or organisations located overseas

- Buying goods and services from overseas suppliers

- Working with other organisations to deliver services and efforts overseas

What are some of the main risks associated with working overseas?

Your organisation’s approach to comply with the ECS should be reasonable, responsible and proportionate considering the size and scope of the overseas activities you participate in.

An assessment of risks vary for each organisation as it is dependent on numerous factors including but not limited to the type of work you take part in, and the country where you are conducting the work.

Some risks which the ACNC has indicated that charities should be aware of, include:

- funds or other resources being stolen or misappropriated

- payments or other benefits being given to individuals who do not qualify as beneficiaries

- funds inadvertently being used to finance terrorism or other criminal activities

- funds being used for purposes other than the charity’s purposes

- an illegitimate donor using the charity for:

- money-laundering (including disposing of the proceeds of crime)

- tax avoidance

- a third party collaborating with the charity not using funds appropriately, not undertaking agreed actions, or not having procedures in place to prevent the types of risks listed above

- difficulty adequately monitor and supervise activities of a charity’s overseas agents and partners.

Risk Management

By law, charities operating overseas are required to have adequate strategies and plans in place to manage these risks and ensure continuous compliance with Australian laws.

Reasonable steps which a charity can take to manage these risks include the availability of:

- policies,

- processes,

- approvals,

- adequate record-keeping,

- security and background checks and,

- formal written agreements

Also, charities must continuously monitor and track all steps throughout the process. These steps can assist to ensure that any funds or resources being sent overseas are used properly, and any overseas activities are overseen and managed properly.

The usual controls a charity may be able to deploy in Australia to help it manage risks such as charitable purpose, financial, fraud, conflicts of interest and vulnerable persons risks – may be unavailable or less effective in the overseas operating environment.

Partnering with third parties

In all situations where you will be working overseas, the organisation will be required to engage the services and assistance of third parties.

Using overseas third parties to distribute funds or to purchase and distribute goods and services to beneficiaries on the charity’s behalf can be an effective way to manage some of the financial and operational risks of a charity’s overseas operations. However, charity governing bodies need to keep in mind that as far as the ACNC is concerned, the charity must still comply with the External Conduct Standards (ECS) for both its own activities as well as those of any overseas partner organisation it outsources to.

Charity Boards may be more confident outsourcing overseas activities to registered Australian charities with the capacity to directly operate overseas because these charities have their own obligations to comply with the ECS.

How can small Australian charities outsource the risks of their overseas operations to overseas organisations?

The ACNC says a charity’s approach to complying with the ECS needs to be reasonable, responsible and proportionate based on the size and scope of its overseas activities.

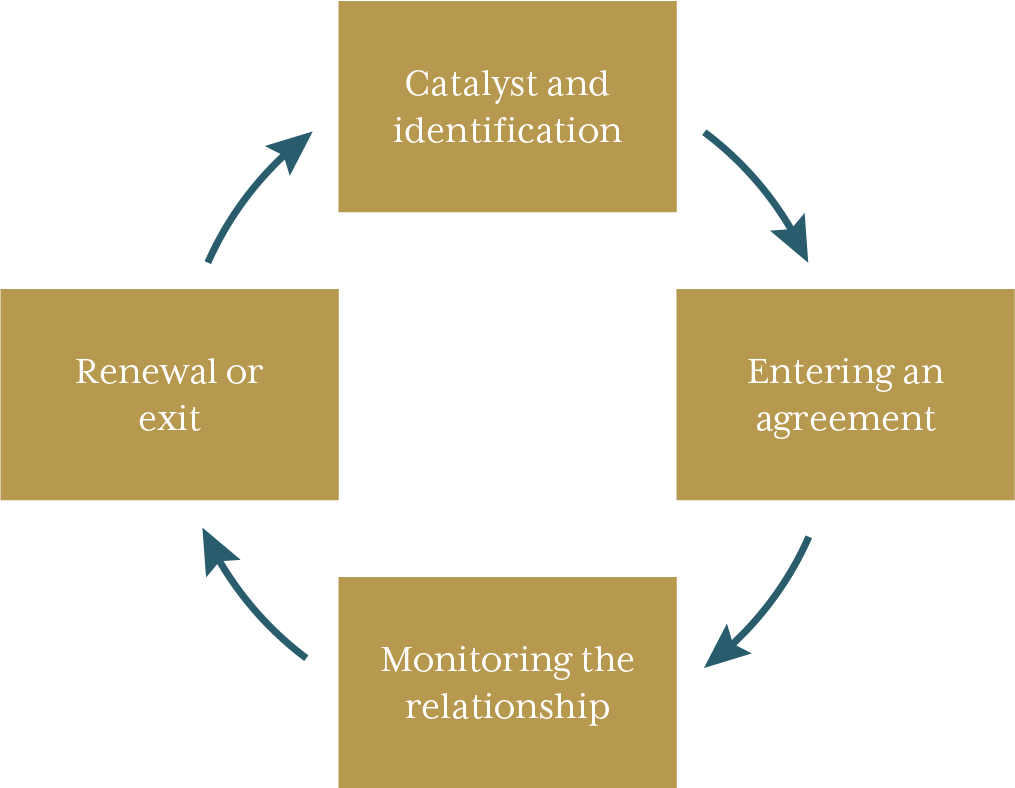

The answer depends on how effective your current policies and procedures are for managing your overseas third-party engagements. Your charity needs to have effective arrangements for managing all 4 elements in the third-party engagement cycle:

Catalyst and identification

Your charity’s other policies and procedures governing body processes should determine whether engaging with a third party is necessary and warranted having regard to your overall and/or project-specific strategy, business plan, objectives, budget, resources and costs risks and benefits.

You should be thinking about potential partners based on their fit with your values and mission and whether they have complementary capabilities.

Entering an agreement

You will need to undertake due diligence on the organisation and its key personnel before entering an agreement. As a starting point, consider applying the same checklist ACNC asks you to apply to your charity to establish whether the third party is complying with the ECS.

You will need the overseas third-party to supply its documents translated into English including:

- Governing document and certificates of registration and relevant licenses

- Decision making and approval policies and procedures

- Code of Conduct

- Organisation chart

- Project plan, project budget and existing project approvals relevant to the project

- Risk Management Plan and project risk management plan

- Policies and Procedures for recruiting and training staff and volunteers and background checks on key personnel

- Complaints and whistleblower policies

- Policies and procedures identifying the financial controls and delegations to prevent financial wrongdoing including, fraud prevention and anti-corruption, anti-bribery, anti-money laundering, and counter-terrorism financing, including financial reporting

- Policies and procedures to ensure that aid address the needs of and reaches its intended beneficiaries

- Policies and procedures for engaging with contractors

- Policies and procedures for identifying and managing conflicts of interest

- Policies and procedures for protecting ‘vulnerable persons’ defined as persons under 18 years of age or other individuals who may be unable to take care of themselves or protect themselves from harm or exploitation

- Policies and procedures for the protection of privacy and personal information

- Emergency exit plans to protect staff and volunteers

- Record-keeping policies and procedures

- Annual financial reports, examples of monthly financial reports and activity reports and project reports

- External referees

- External reviews, auditors reports of the organisations operations and finances

Monitor the relationship

Once you are confident your overseas third-party has the policies and procedures in place that will enable your charity to comply with the ECS, you need to test the policies and procedures are actually operating before you commit. To do this you need to consider what records the relevant process or procedure says it generates and ask for copies of the relevant records.

For example, if the organisation provides you with a staff and volunteers policy that says it screens its staff and volunteers you should call for the screens on key staff that will work on your project. If they say they provide monthly financial and operational reporting against project budgets to overseas donors – call for examples.

In your due diligence you are looking for potential show-stoppers like:

- Poorly identified and managed conflicts of interest

- Incompatible values, aims, work or relationships

- The failure of the organisation to identify and address potential integrity issues such as bribery, fraud and corruption in its policies and procedures

- Unfavourable financial history

- Poor financial controls, lack of appropriate financial delegations, or regular financial reports

- Concerns about the organisation’s corporate structure and ownership

- Issues about its capabilities and business support capacity

- Troubled reputation and legal history

- The organisations in a prospective partner’s supply chain (the ‘fourth’ and ‘fifth’ parties)

- Inadequate annual reporting concerning public submissions

- Incompatible perspectives of senior executives, managers and staff

- Controversial social media presence

- Absence of strategy to manage particular ‘in country’ risks

- Lack of willingness to transparently share information or respond to information requests

- Early termination of other projects by other partners

- Lack of regular reporting to nominated referees

- Lack of publicly accessible and transparent complaints system

Next, you need an enforceable agreement with the third party that will enable you to deliver against your charity’s obligations under ECS. It is critical to ensure you have a mechanism. This mechanism requires your partner and its officers, employees, agents and subcontractors to comply with key ACNC requirements and Australian laws. It also provides warranties that it will not cause your charities to breach any laws of the host country applicable to the performance of the agreement and Australian laws concerning:

- money laundering

- financing of terrorism

- sexual offences against children

- slavery and slavery-like conditions

- trafficking in individuals and debt bondage

- people smuggling

- international sanctions

- taxation, and

- bribery

You also want your overseas partner to warrant it has in place adequate policies, procedures, financial controls and risk management plans:

- to prevent and manage risks of financial wrongdoing including fraud, money laundering, financing of terrorism, and the bribery of officials

- to safeguard the intended beneficiaries, its staff and volunteers who may be vulnerable to sexual and other forms of exploitation

- to ensure it creates and maintains proper records of financial and operational matters concerning the project

- to manage conflicts of interest

Your partner should commit to regularly communicating with you and provide regular reporting against project deliverables. At your request, they should agree to provide information and comply with any reasonable request by you to remedy any concerns that arise during the engagement as this helps you to meet the ACNC’s expectation that you monitor the activities of your overseas partners.

Renewal or exit

The ACNC expects you to evaluate every overseas project as part of your project planning and approval process. So you also need your partner to agree in advance to participate in any post-project evaluation. Evaluation is essential to deciding whether to renew or terminate a partner arrangement. Your agreement should give you rights to amend, renew, and conversely terminate with notice or for a cause. Your rights to access your partner’s records and documents should extend beyond the completion or termination of the agreement.

Getting this level of engagement and commitment from overseas organisations is a big ask for smaller Australian-based charities – virtually forcing you to work with large reputable international organisations if you are going to comply with ACNC expectations. Yet, overseas charities may not agree to submit to the Australian charities regulator’s compliance requirements and refuse to take donations from Australian charities.

One has to ask whether the ACNC’s expectations are realistic, particularly for charities working in areas of high need in countries where the institutions of government and civil society have broken down.

By making it much harder for smaller Australian charities to do this work directly, ACNC may be hoping organisations opt to work with a larger Australian partner to distribute aid overseas.

Addressing the risks and uncertainties of operating overseas

For some of the organisations we work with, getting aid more directly to the world’s most needy people in some of the world’s high-risk places is a risk worth taking. If you’re up for the challenge, we’re here to help you do it the right way.

If your organisation would like advice on operating overseas under the ECS – get in touch with our NFP team and we would be happy to have a chat with you! You can find us on (02) 9018 1067.